My good friend and leadership consultant, Doug Smith always says “we were not meant to life alone!” I completely agree. I believe as humans we are designed by God to do life together. We all need help and we are stronger together than alone. We can all use a “coach.”

I would define a coach in a broad sense, as someone that helps you accomplish your goals and achieve more than you could on your own. Coaches come in many forms. You have your traditional sports coach that most of us are familiar with. I would even define the teachers we had in school as coaches. Some other examples that would fall under my broad definition of coaches are personal trainers, therapists, running coaches, money coaches, mentors, and financial planners.

Why do we need coaches?

- We tend to be emotional when making decisions that affect ourselves, but we tend to be rational when the decision is for someone else. A coach can help us make rational decisions.

- When we make decisions, our emotions can cause us to think differently than we normally would. A coach can help us think through decisions and remove some of the emotional bias.

- We tend to judge ourselves by our intent and others by their actions. A coach can look at our actions and help us to make better decisions.

- Our minds tend to tell us to stop before we have hit our limits. A coach does not feel the same emotions you are feeling and can help you push through mental barriers.

- Others can see you from a different point of view and can therefore show you things you do not see. A coach can point out flaws you did not see.

- We tend to procrastinate things that are not urgent. A coach can hold you accountable to those tasks.

- We tend to overestimate what we can do in a month but underestimate what we can do in a year. A coach can help you take a long-term view and work to get there over time.

We need coaches because we are emotional decision makers. We all need help to accomplish our goals and achieve more because again we were not meant to do life alone.

Think you don’t need a coach and you can do it on your own? Think about these successful people who use multiple coaches in their lives:

- Bill Gates

- Oprah Winfrey

- Jeff Bezos

- Ben Roethlisberger

- Michael Jordan

- Serena Williams

- Michael Phelps

People hire coaches for many parts of their lives but often neglect a coach for their financial plan; a financial planner. Your financial plan is one of the most important parts of your life. Failing to have a proper financial plan can lead to stress and lower your quality of life. As the saying goes, people do not plan to fail but they fail to plan. Creating a plan can give you the long term focus you need to achieve your goals while providing you the action steps needed to pursue them in the short term.

A financial planner can empower you to:

- Determine what is important to you.

- Define your financial goals.

- Create a plan to pursue those goals.

- Identify possible obstacles to those goals.

- Develop action steps to implement that plan and avoid obstacles.

- Stress test your plan.

- Monitor your plan.

- Adapt your plan as your circumstances and goals change.

- Stick to your plan.

Creating a plan is hard. It helps to have a third party to listen, understand and help you. A third party can help you clarify your goals. Once a plan is created, the hardest part is sticking to that plan.

I am a marathon runner. The easiest part of running a marathon is creating the goals and the plan. I am not saying that part is not hard, but it’s the easiest part of the process. The hardest part is sticking to the plan over the course of several months. It’s easy to get off track when you must fit a run among other obligations. It’s easy to get off track when it’s snowing outside. It’s easy to skip one day because the training is several months, but my coach helps me to stay on track.

Sticking to your financial plan can be even more tough. It can be hard to focus on long term goals when we tend to focus on the short term. It’s easy to stop saving for retirement to help you have more money now. It’s easy to pull your money out of investments when the markets have down turns. It’s easy to get sidetracked. That is where a financial planner can help you stick to your plan.

It is easy on paper to say you can stomach setbacks like loss of employment or market downturns on your own, but emotions are real, and they are hard to replicate without going through it. When the markets are down, and you open your statement to see how much money you have lost it can be painful and cause you to make a poor emotional decision.

When you lose your job and you are trying to decide on what to do, it can be hard to continue to contribute to your retirement. When you really want something you have dreamed about for a while, and you have an opportunity to purchase it, those emotions can cause you to forget your plan and make a poor emotional decision.

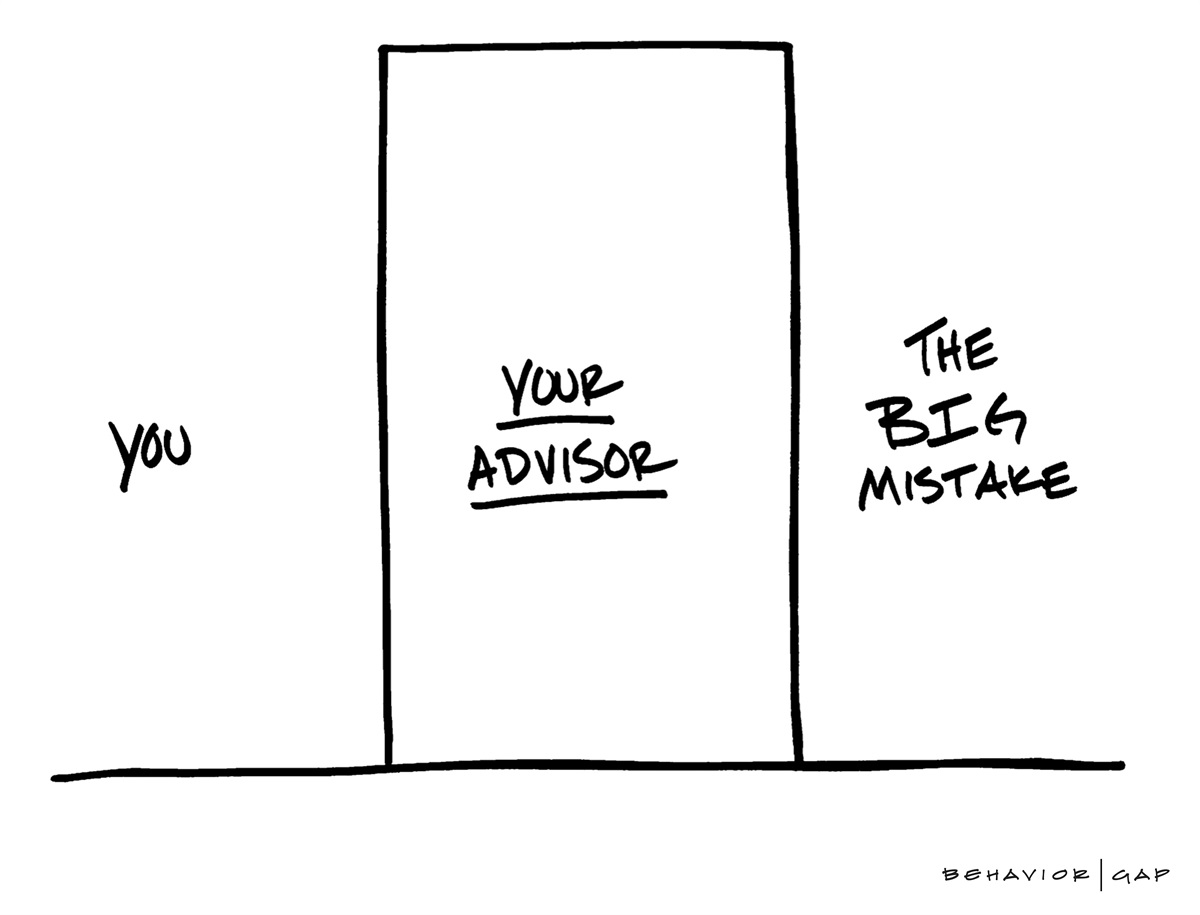

Life is not easy. We all make mistakes. We will get sidetracked. You will need to readjust your plan. However, your financial planner can be the person between you and the big mistake!

If you do not have a plan or want help sticking to your plan, give one of our advisors a call today at 412-357-2002. We would love to give you guidance with a plan.

If you found this information helpful, please share it with a friend.

This is meant for educational purposes only. It should not be considered investment advice, nor does it constitute a recommendation to take a particular course of action. Please consult with a financial professional regarding your personal situation prior to making any financial related decisions. Investing involves risk, including the potential loss of principal. 03/20

An Impact So Great Our Community Would Weep If We Closed Our Doors

Part of our 412 Vision at Beratung Advisors is to have “An Impact so Great Our Community Would Weep if We Closed Our Doors.”

Generational Planning for Yinz

After eight years, we are changing our tagline from “Guidance with a Plan” to “Generational Planning for Yinz.”

4 Keys to Hearing God’s Voice

I first learned these 4 keys to hearing God’s voice on an L3 Mastermind Retreat from my friend Andrew Reichert, and it changed my life.

Give ‘Em The Pickle

We believe that a big part of culture is shared language. We have a shared language we call the Beratung Vernacular that helps us all row in the same direction.

13 Lessons I Learned From My Dad

My father was called home to be with God 13 years ago on Thanksgiving Day, November 24th, 2011. Today would have been his 76th birthday. There is not a day that goes by that I do not think of my dad. In his memory, I wanted to share the 13 most important lessons he taught me, one for each year he has not been with me.