Investment Management

Our Philosophy

We believe that investment management is one part of a client’s financial plan.

We believe every person should have a financial plan, but not all of our client’s need investment management services.

Some of our client’s choose to do their own investments or use investment services we do not provide such as investing in real estate, investing in private business or commodities to name a few.

The majority of our planning clients choose to use us for investment management because they find our philosophy is a match for them.

We believe

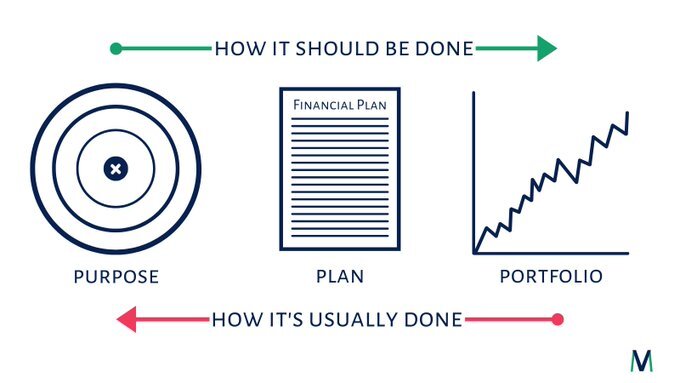

- A client’s financial plan is the best way to help them understand their portfolio needs

- In a long-term approach to investing

- We cannot predict the markets

- You can control

- your savings rate

- your emotions

- your actions

- You cannot control

- decisions of board of directors

- decisions of governments

- the markets

- Time inside the market is a better strategy than attempting to time the market

- Political changes, economic changes, and global macro events impact investments but most investors overreact to these events and make emotional short term decisions

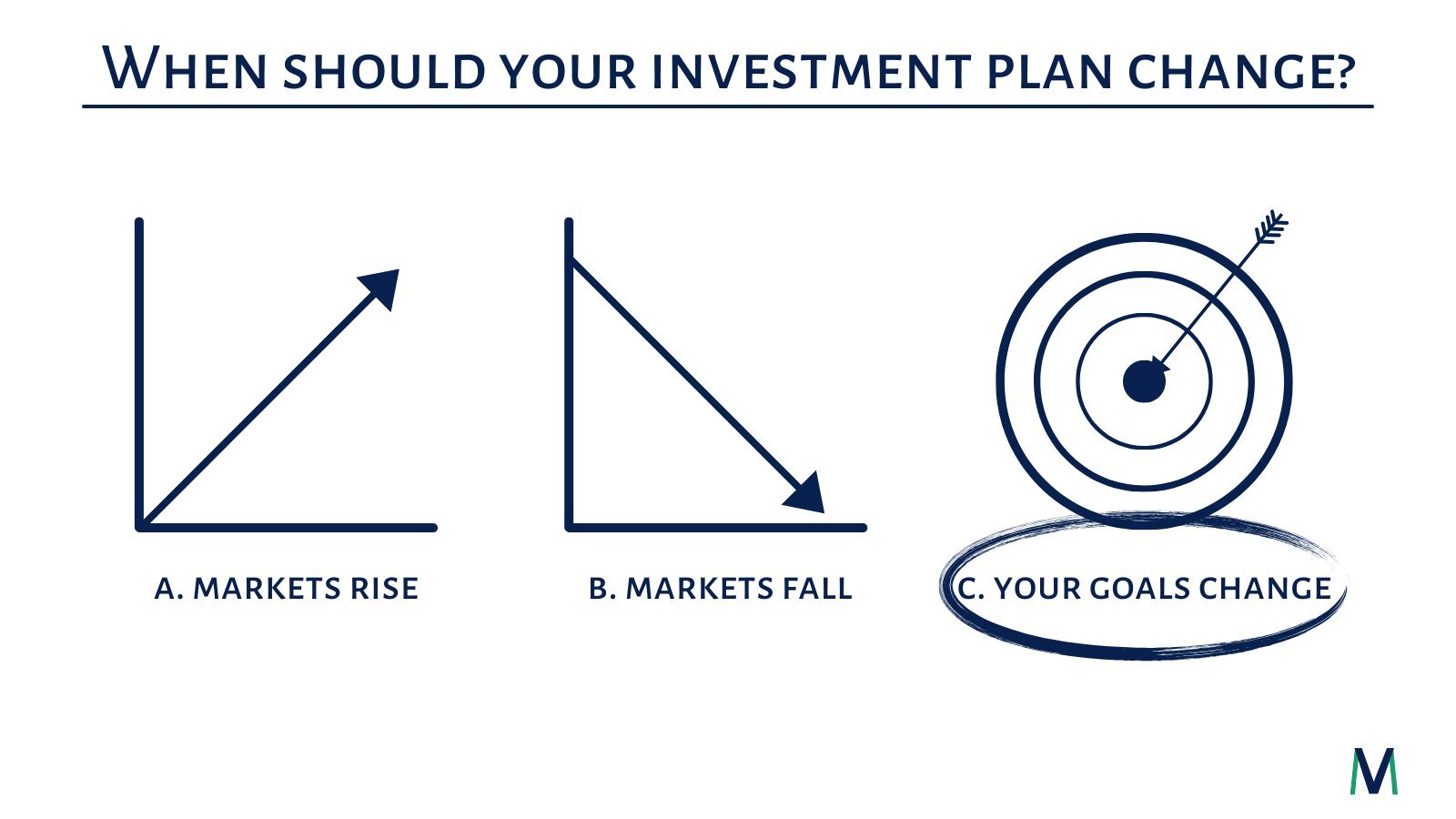

- Clients should stay invested in a portfolio that matches their goals and risk tolerance unless their goals or risk tolerance changes not because of fear

- Clients should not sell out of their investments because the markets are down. The reasons for selling out of investments should be related to changes in their financial plan, goals, allocation, risk tolerance, or liquidity needs.

- Focusing on controlling risk is a more effective strategy than focusing on returns

- In attempting to get market like returns with reduced risk, not attempting to beat the markets

Investment Management

1.00%$5,000-$2,000,000

0.60%$2,000,000.01-$4,000,000

0.40%$4,000,000.01-$10,000,000

0.25%<$10,000,000.01

Advisory Fee / Account Value

Portfolios

We have several portfolios based on modern portfolio theory.

Our standard portfolios use active and passive management through mutual funds and ETFs.

We also offer each model in

- Tax efficient

- ETF only

In addition to the above we offer custom portfolios based on situational clients needs. This typically includes clients with existing positions in portfolios that we have decided to keep or have special needs from their portfolios.

Our first priority is helping you take care of yourself and your family. We want to learn more about your personal situation, identify your dreams and goals, and understand your tolerance for risk. Long-term relationships that encourage open and honest communication have been the cornerstone of my foundation of success.

Biblically Responsible Investing

In addition to our portfolios, we also offer Biblically Responsible investments through LPL. These strategies use investments that align with principles inspired by the Bible. Funds made available in the models are selected by LPL Research using a variety of sources, including Biblical investing communities and organizations such as Kingdom Advisors and Faith Driven Investor, to identify funds that incorporate principles inspired by the Bible into their investment process. LPL Research uses Morningstar data to evaluate the investment universe to ensure that the funds employ exclusionary screens on Biblically-guided criteria. LPL may add additional funds to the model in the future that are determined to employ Biblical values in their investment process.

Biblically Responsible Investing (BRI) investing / Faith Driven Investing (FRI) has certain risks based on the fact that the criteria excludes securities of certain issuers for non-financial reasons and, therefore, investors may forgo some market opportunities and the universe of investments available will be smaller.

Focus On Core Principles

The funds in the models use exclusionary filters, or screens, to avoid companies that violate core biblically inspired principles. Biblically responsible funds may also target companies that positively impact their communities, the environment, and society.

Targeted Investments

The exclusionary filters vary by fund, but most funds seek to exclude companies with a material business exposure (as defined by the fund) related to the filter. In some cases, materiality is not considered and all companies with a business exposure will be screened out.

Strategic, Long-Term Investment Approach

LPL employs a strategic, long-term oriented investment approach, providing sustained exposure to US and foreign equity markets. This model is appropriate for investors who are seeking long term capital appreciation and can withstand periods of significant volatility and capital loss.