Empowering Yinz to Make Informed Financial Decisions.

Published In & Quoted By:

"Am I on track?"

- To retire

- To pay for my child's college education

- To have financial freedom

What questions do you want answered?

We know you are overwhelmed with a busy life and after a long day it’s hard to prioritize making financial decisions, so you make decisions without knowing the impact on your goals/life.

We help you see if you are on track to meet your financial goals.

Your financial planner partners with you, not just to make decisions, but informed financial decisions.

We make it simple for you.

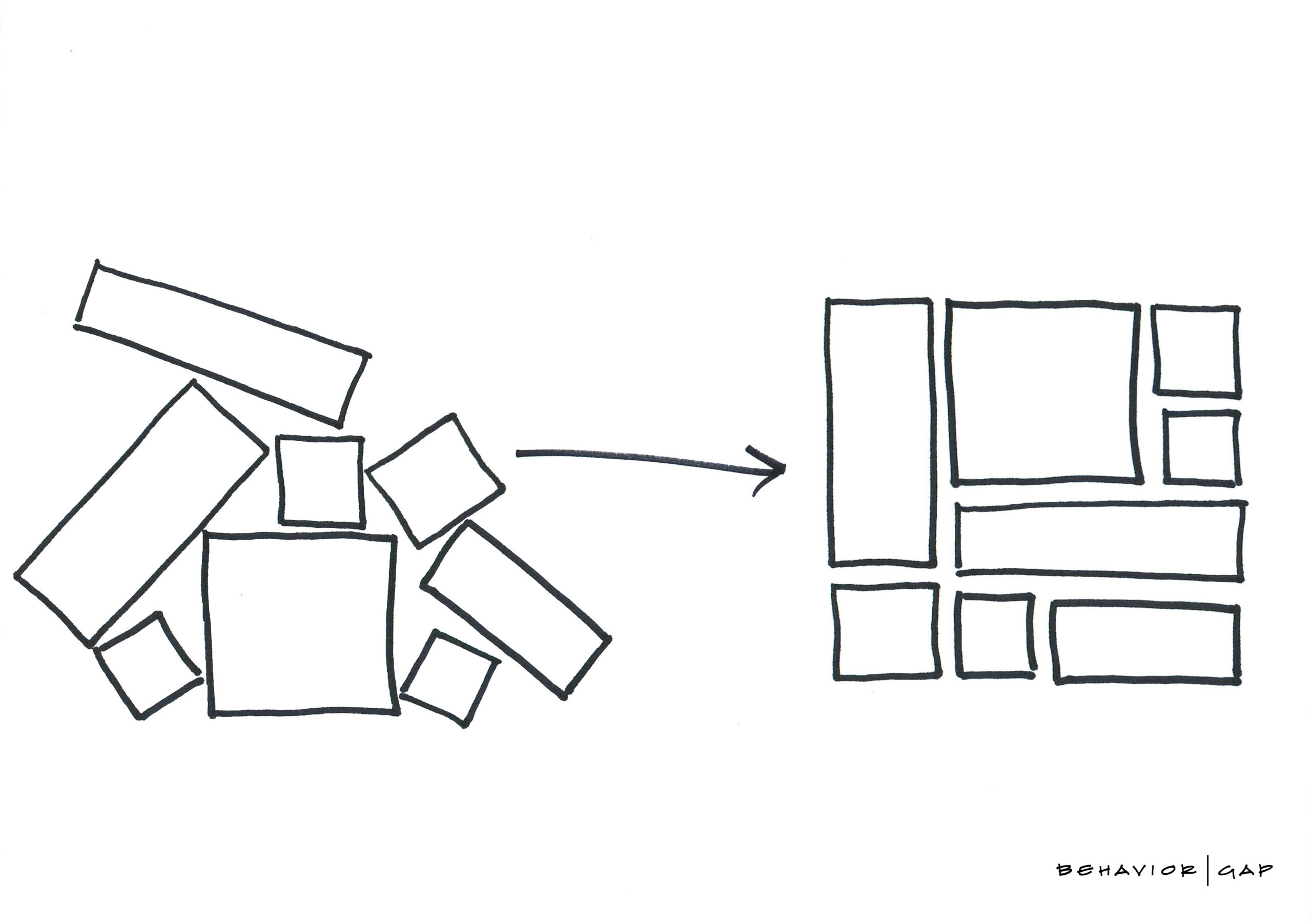

Most people’s finances are scattered and complicated.

We help you organize your financial resources and goals into an easy-to-use client portal so that you have simple access to your financial life, regardless of your financial means.

eMoney

Your life in a box

Our Services

We help clients create personalized comprehensive financial plans to help them pursue their financial goals. We can walk you through a step-by-step financial planning process that can help make you feel confident in your financial decisions. We focus in the following financial planning areas:

Present Financial Position

This is also referred to as Cash Flow Planning and is the basis of financial planning. This includes budgeting, financial forecasting, understanding your net worth, income, expenses and debt management. It’s the basis of financial planning so you can understand your overall financial picture.

Protection Planning

This is also referred to as Risk Management or Insurance Planning and is often done after Cash Flow Planning. It helps to understand what protection strategies you may need now before focusing on the future in the other four areas. This includes life, disability, health, vehicle and property insurance to name a few. Depending on your stage in life, your insurance needs (risk management needs) will change and evolve.

Retirement Planning

Once you understand your resources and protection strategies, it’s important to start building your plan for retirement. This is also referred to as Income Planning when you are already retired. This is commonly the cornerstone and most important part of planning for the clients we work with. This includes Social Security planning, Medicare planning, income planning and goal setting. It involves using your cash flow and financial position along with reasonable assumptions to make forward projections about your future and then turning the resources you have into income streams to live from.

Investment Planning

After retirement planning you will want to take a look at how your assets are allocated and create a plan to manage them. This includes asset allocation strategies, diversification and understanding your risk tolerance. Then create a plan for managing your investment strategies and risk in alignment with your retirement planning goals.

Tax Planning

Tax Planning is not only done after Investment Planning but also plays an important role in every area of planning. The following is a cliché saying, “It’s not what you make but what you keep.” We think this sums up the focus of this planning work. It involves reviewing your tax return and creating strategies to minimize tax burden not only now but in the future. Be careful not to be too focused on this planning because as another cliché goes, “You can’t let the tax tail wag the dog.”