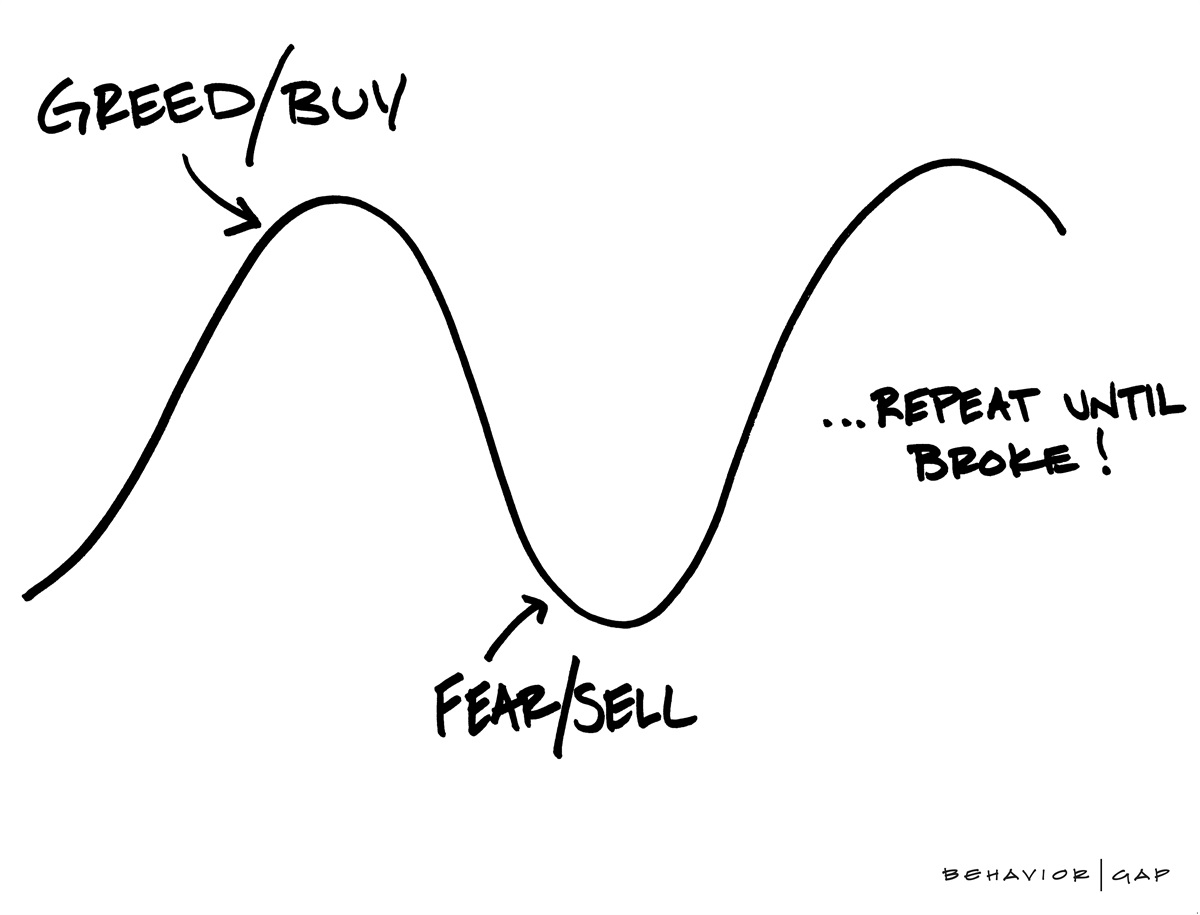

Most of us have heard that we should “buy low and sell high” and “stay the course” during market downturns. However, like most things, it’s easier said than done. The reality is we are hard wired to do the opposite. Our natural reaction when the market is going down is to sell and when it’s going up is to buy. In other words, our reaction is to sell low and buy high. I hear all the time in up markets, that I would not sell. However, statistically most people sell in down markets or it would not be a down market. Think about it, if the market is going down that means there are more sellers than buyers, so in down markets most people sell. If the market is going up that means there are more buyer than sellers, so most people buy when the markets are going up.

Why is this? It’s human nature! When you see your accounts losing money it’s hard handle. Your advisor can show you charts and plans that predict what it feels likes to lose money but that does not replicate the feeling of opening your statement and seeing your account losing that money. It’s frustrating and it is scary.

Most people’s first reaction is I need to sell to make it stop. They want to get out of the markets until things normalize. It seems like a good strategy at first, but the problem is no one can predict the markets. When you pull out and decide to get back in, based on human nature, it will most likely be when the markets have recovered, and you have lost a lot of the earning potential.

Long term investing in the markets is tough but has historically been successful over long periods of time even given the Great Depression, stagflation in the 70s, the dot com crash, the terrorist attacks of 9/11 and the Great Recession.

The reality is we cannot predict the market. It’s not just us, no one can predict the markets. There will be times where the markets go down and it will be tough. We believe the best thing you can do for long term success is to create a comprehensive financial plan based on your goals and then invest your money based on your financial plan and have a trusted advisors that can help you stick to that plan.

To review:

- Staying invested in down markets are tough.

- Create a plan to help you not make an emotional decision that will negatively impact your goals.

- Hire a trusted advisor to help you stick to that plan.

If you do not have a plan, give one our advisors a call today at 412-357-2002. We would love to give you guidance with a plan.

If you found this information helpful, please share it with a friend.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. The information presented does not constitute a solicitation for the purchase or sale of any security and is not a recommendation of any kind. Please consult your financial advisor before making financial decisions. Investing involves risk, including the potential loss of principal. Past performance is not a guarantee of future results. 03/20

eMoney 103: Data Input – Asset Allocation

In the ninth class of eMoney Masterclass 103 our CEO Greg Furer reviews how to input savings, contributions and withdraws into your client’s financial plan.

eMoney 103: Data Input – Savings, Contributions and Withdrawals

In the ninth class of eMoney Masterclass 103 our CEO Greg Furer reviews how to input savings, contributions and withdraws into your client’s financial plan.