In the media today, you are often inundated with information about firms offering financial services. The messages you see may typically be focused on management of assets or focused on helping to develop a financial plan to achieve specific financial goals. You might be led to think of these services as one and the same, when they are two distinctly different services.

In an asset management relationship, an advisor works with you to manage your assets. This management will be based upon how much risk they can tolerate, what your time horizon is, and what kind of specific return you hope to achieve. They will take this information and help create a portfolio. That portfolio will be monitored over the years to help make sure it still fits your objectives and will be adjusted as needed to keep the objectives in line. There will typically be buys and sells, rebalancing of the portfolio, and changes to the investments throughout time. This strategy can help to achieve these particular goals, but we believe most clients are looking to achieve more than just a risk-based return over time. They want to gain answers to more specific questions or concerns about their financial life.

In a financial planning relationship, an advisor will work with you to help answer more in-depth questions and concerns. Things like, is my retirement goal attainable or do I have to work longer? Can I send little Jimmy or Jenny to college and not have them incur a lot of debt? If I do not live long enough what will happen to my wife and kids? Or, how would my family make ends meet if I walked out of this office and had a serious accident and cannot work any longer?

To get these answers it takes more than simply looking at how much risk a portfolio is taking or how it is performing. You work with your advisor to first develop your goals and concerns by having discussions and looking at your financial situation from multiple angles. Once you have developed the goals and concerns you can then construct a plan that provides a path to pursue the goals and address the concerns. This is the financial planning approach to a relationship.

There can be instances where some clients need their assets managed without a comprehensive plan. However, we feel that in most cases a client needs a financial plan before they can create the proper asset management structure to address their goals and concerns.

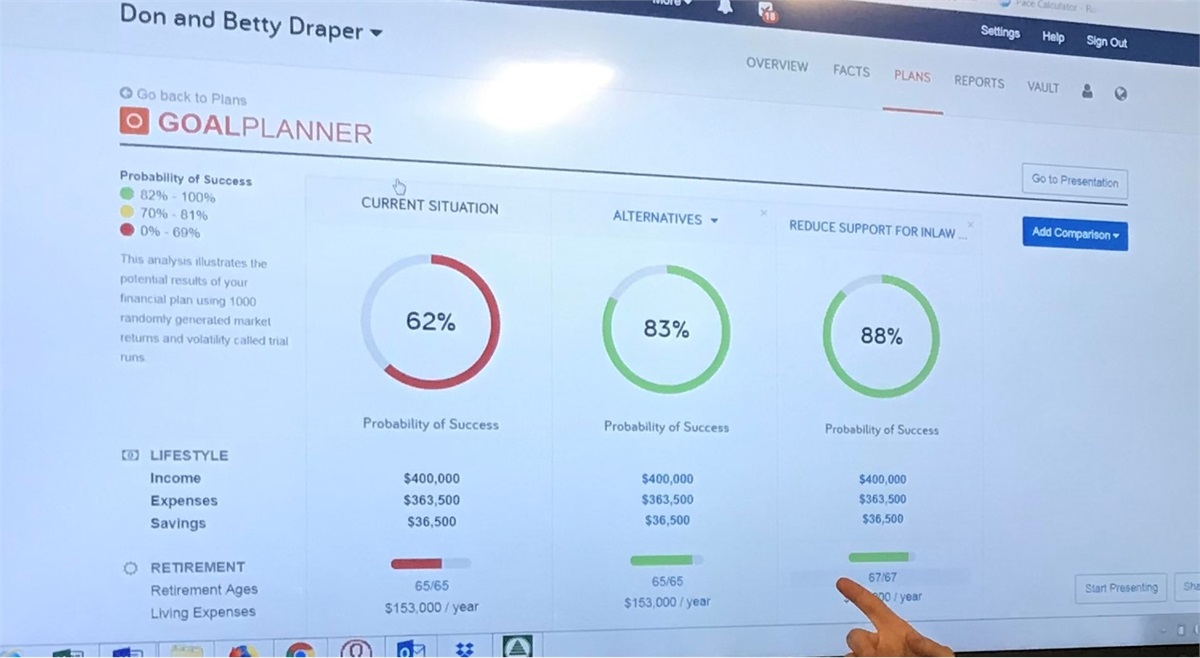

When you discuss all of your goals and concerns with an advisor and include them in a plan, it allows for them to be tested and analyzed to help make sure steps can be taken to correct issues or build upon strengths in your financial life. You may be doing things that you feel are improving your financial situation without truly knowing how or why you are doing them.

You may be maximizing your 401(k) contributions and feel you are well on pace for retirement based on the amount you have saved, but what about what you are saving outside of that 401(k) and how can this be beneficial for income in retirement? What if you are vastly behind in your savings needs based on your overall lifestyle?

You may have life insurance through work, and it will give your spouse or other heirs two years’ worth of your salary, but what if you pass away in your early 40s with over 20 years of prime earnings left? In both instances you have checked the box. You are saving and you have planned for an untimely death.

However, you may be overlooking critical aspects of these goals. By planning and testing different scenarios you can see how to take steps to add more savings over time or obtain a life insurance policy more in line with your family’s needs. Your plan should help make sense of the financial instruments you use and why you use them.

Asset management and financial planning are two different services. The advisor, based upon your relationship, can provide you with one or both services. Instead of just looking at asset management or financial planning I recommend creating a comprehensive financial plan that will serve as a guide to developing the asset management strategy you need. The two would then work as compliments to each other rather than as opposing forces.

To find out more about our approach to comprehensive financial planning here at Beratung Advisors, please give us a call at 412-357-2002. And, as always, if you found this information useful please leave your comment on our Facebook post or on our advisors’ LinkedIn posts and share this post with your friends and family.

This is meant for educational purposes only. It should not be considered investment advice, nor does it constitute a recommendation to take a particular course of action. Please consult with a financial professional regarding your personal situation prior to making any financial related decisions. Consult your financial advisor for a breakdown of the fees associated with these services.

13 Lessons I Learned From My Dad

My father was called home to be with God 13 years ago on Thanksgiving Day, November 24th, 2011. Today would have been his 76th birthday. There is not a day that goes by that I do not think of my dad. In his memory, I wanted to share the 13 most important lessons he taught me, one for each year he has not been with me.