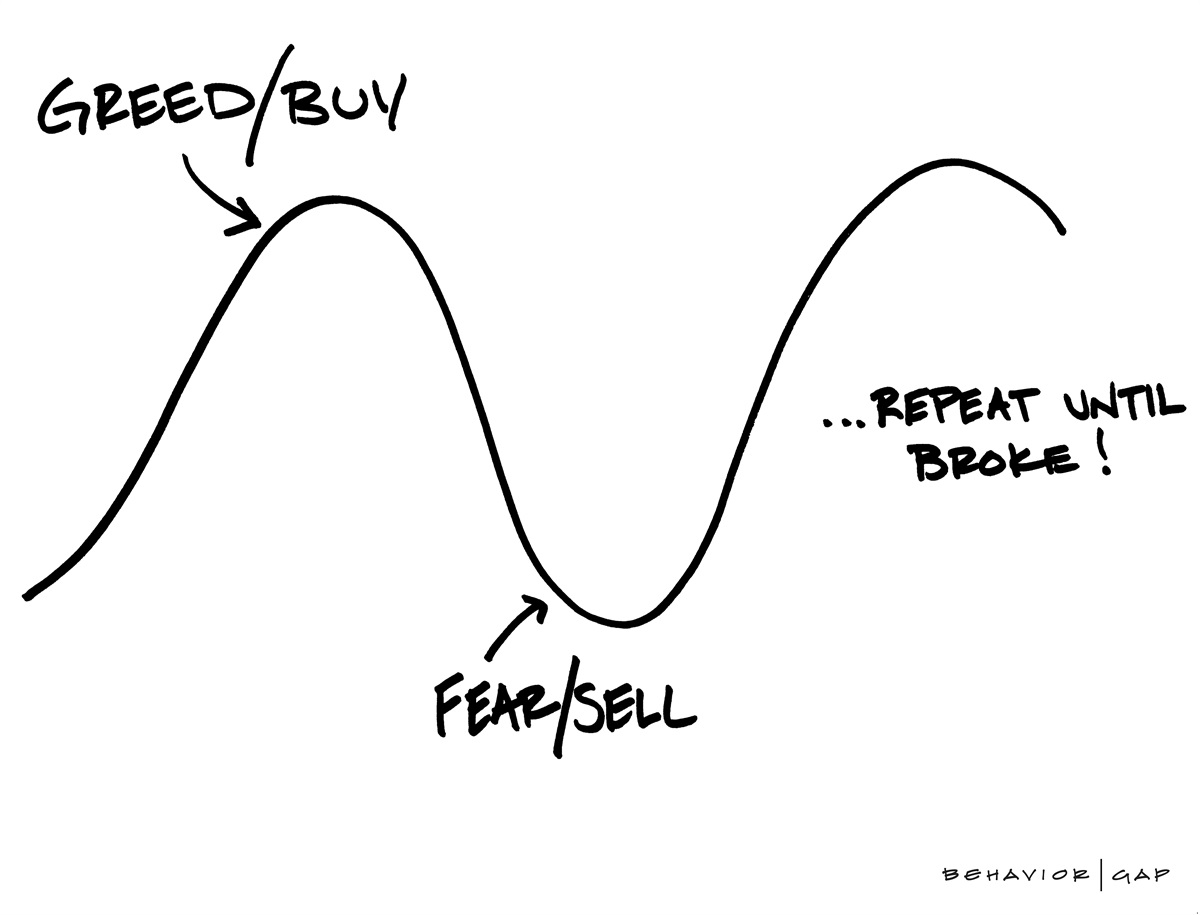

During volatile times in the markets, there tends to be very little room for optimism. Many people have seen their investment portfolios decrease in value. This can lead investors to feel considerable emotions and prompt them to make rash investment choices that may not be beneficial in the long term.

You’ve probably heard or seen that during down markets investors tend to make emotional decisions that may hurt them in the long term. Many of us have heard a similar story perhaps from a friend, co-worker, or family member about how much they lost in the 2008 financial crisis and never gained that money back.

If you had asked them why they never gained it back, the answer you might have heard would go something like this: well, when the market got so low, I couldn’t take seeing my portfolio decrease anymore, so I sold out my investments and put my money into cash.

If you sell investments during market declines you’re locking in losses. Depending on what you own selling may be a good decision. However, selling everything in your portfolio simply because the market is down – historically has not been a wise investment decision. Selling during downturns and getting out of the market eliminates the possibility of recouping any losses.

Some people might say they want to sell and then reinvest by attempting to time a good re-entry back into the markets. They say that when things are good, they’re gonna consider reinvesting their assets. When’s a good time to reinvest? Even the greatest investors in history will tell you that it is nearly impossible to time the markets.

As an example, if someone sold their investments on March 9, 2009, the lowest point during the 2008-2009 bear market when the S&P 500 closed at 676 that day, without re-entering the market, the investor effectively would have missed out on the bull market that followed which saw the S&P 500 rise to 3,231 on December 31st, 2019.

Just so you know, that’s a 378% gain. These figures refer only to the S&P 500 index which is an unmanaged index made up of 500 largest U.S. publicly traded companies, but I hope it helps drive the point home that market declines are normal and are not the time to let your emotions take over.

You should remember that we, as human beings, are emotional creatures by nature. We tend to want to move towards the things that are good and away from the things that are bad. Think of the example noted earlier – would you rather have invested when the S&P 500 was at 676 or 3231? Remember the investing principle of buying low and selling high!

The S&P 500 as of close of business on March 31st 2020 was down by 20% year to date. It’s not easy to see portfolios go down during this time, but historically it is better to take advantage of double digit drops then to try and time a market bottom. Of course, markets could at any point drop further. Remember that investing should be done with careful consideration and after thorough evaluation of your entire financial picture. We believe the best way to know what investments fit your goals and objectives is to speak with a financial advisor and complete a comprehensive financial plan.

We can help you position your assets in line with your specific financial objectives and goals.

I often say to clients, I could walk over and ask 10 random people when they should buy stocks and when they should sell them. My best guess is that most people would tell me you need to buy low and you need to sell high. But I would also guess those same people would have a story about someone close to them that did the opposite and ended up regretting it in the end.

The last two bear markets, the 2000 dotcom crash and the 2008 financial crisis, remind us that the financial markets have bounced back.

If you want to put your assets to work, it’s important to create a comprehensive financial plan that takes into account your personal financial situation, your risk tolerance, time horizon and goals. If you don’t have a financial plan reach out to us today so we can help you.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. The information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to the accuracy and is not intended to be used as the basis for any investment decisions. The information presented does not constitute a solicitation for the purchase or sale of any security and is not a recommendation of any kind. Please consult your financial advisor before making financial decisions. The S&P 500 index is unmanaged and you cannot directly invest into an index. Investing involves risk, including the potential loss of principal. Past performance is not a guarantee of future results.

13 Lessons I Learned From My Dad

My father was called home to be with God 13 years ago on Thanksgiving Day, November 24th, 2011. Today would have been his 76th birthday. There is not a day that goes by that I do not think of my dad. In his memory, I wanted to share the 13 most important lessons he taught me, one for each year he has not been with me.