An important part of financial planning—one that often gets overlooked—is your property and casualty insurance.

I always say that the property and casualty industry has done a poor job educating people, and it shows in their marketing.

Because what do we hear from them? “Take 15 minutes to save 15% or more.”

But I don’t believe for a second that you can truly understand your insurance coverage—something that could protect or completely wreck your financial plan—in just 15 minutes.

You have to understand how your property and casualty coverage fits into your entire financial plan. And too often, people don’t realize how critical it is until something goes wrong.

What If the Worst Happens?

I hear so many concerns from people about how things like market downturns and inflation could affect their financial plan.

- “Greg, what if the markets go down?”

- “What if inflation goes up?”

But you know what I don’t hear?

- “Greg, what happens if my 16-year-old gets into a serious car accident?”

- “What happens if a tree falls on my house?”

- “What if there’s an explosion three houses down from me?”

And let me tell you—these things actually happen.

Every one of those examples? They are real situations that have happened to my clients.

These are not rare freak accidents—they happen far more often than you’d think. And if you’re not properly covered, they can cause extreme financial pain that takes years to recover from.

Understanding Homeowners Insurance

Let’s start with homeowners insurance, because most people don’t actually understand their policy.

If you have your declarations page handy, grab it and follow along.

Key Parts of a Homeowners Policy:

- Premium: This is the amount you pay for coverage.

- Most homeowners policies are 12-month terms, but some are six months (especially if bundled with auto).

- Before comparing policies, make sure you’re comparing apples to apples—a cheaper premium might mean less coverage.

- Dwelling Coverage: This is your actual house—the part that burns down in a fire.

- But do you have enough coverage to rebuild?

- A policy written years ago may not reflect current rebuilding costs.

- Separate Structures:

- Detached garages, sheds, pool houses—even that “She Shed” from the commercials.

- Personal Property: This is everything inside your house.

- Cash, jewelry, guns, collectibles—yes, those all fall under personal property.

- But read your policy carefully—things like cash and jewelry have strict limits.

- A client of mine had a purse stolen from her car at a Pittsburgh Penguins game. The broken window was covered by auto insurance, but the purse? That was only covered under her homeowners policy.

- Loss of Use:

- If your home is damaged and unlivable, this covers hotel costs, temporary housing, and additional expenses.

- Think about it—if your house was unlivable for a month, where would you go?

- Liability Coverage: The Most Important Part

- If someone sues you, this is what protects you.

- I’ve seen people sued because their dog bit someone.

- I’ve seen homeowners sued because a contractor got electrocuted while cutting down a tree.

- If you don’t have at least $500,000 in liability, you’re exposing yourself to unnecessary financial risk.

Auto Insurance: “Full Coverage” Doesn’t Mean What You Think It Does

One of the most misunderstood areas of insurance is auto coverage.

I had a friend call me after a serious accident, saying:

“Greg, I have full coverage—I’m fine, right?”

But when we checked? Her liability coverage was only $50,000.

The actual damages were over $300,000.

Guess who was responsible for the remaining $250,000? She was.

Critical Auto Coverages You Need to Check Right Now:

- Bodily Injury & Property Damage:

- You need at least $250,000/$500,000.

- Uninsured & Underinsured Motorist Coverage:

- 1 in 8 drivers has no insurance.

- If someone without insurance hits you, your coverage is the only thing protecting you.

- Tort Selection (PA, NJ, KY Residents Pay Attention!):

- Full tort allows you to sue for pain and suffering.

- Limited tort restricts your rights—but people don’t realize this until it’s too late.

I’ve had clients who chose limited tort because it saved them money—but then, when they were in a life-altering accident, they deeply regretted that decision.

Umbrella Insurance: The Most Overlooked Yet Most Valuable Policy

I could tell story after story about lawsuits that blindsided my clients.

But one that stands out?

A client’s dog bit a mailman.

- The mailman sued for medical bills.

- He also sued for emotional distress and PTSD.

- Total cost? Over $500,000.

- Their homeowners insurance only covered $300,000—they would have been on the hook for the rest.

But they had a $1M umbrella policy.

For $200-$400 a year, they had an extra layer of protection that saved them from a financial disaster.

If you own a home, drive a car, or have any assets, you need umbrella insurance.

Final Thoughts: Don’t Find Out the Hard Way

Property and casualty insurance isn’t exciting—but when something happens, you’ll either be grateful you had the right coverage or wish you had taken this more seriously.

Here’s what you need to do right now:

- Pull out your homeowners and auto insurance policies.

- Check your liability limits—do you have $500,000 or more?

- Do you have uninsured/underinsured motorist coverage?

- Make sure you have replacement cost on your home, not market value.

- Talk to your agent about an umbrella policy.

Because insurance isn’t just about protecting things—it’s about protecting your financial future.

And when the unexpected happens?

You’ll either have a plan—or a financial disaster.

Why Property & Casualty Insurance Is a Critical Part of Your Financial Plan

An important part of financial planning—one that often gets overlooked—is your property and casualty insurance.

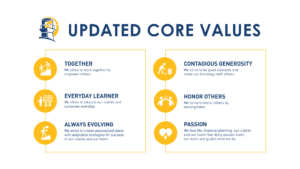

Refining Our Core Values: Making Them Clearer, Stronger, and More Actionable

At Beratung Advisors, our core values are the foundation of everything we do.

Make Your Vision Great Again: Why Clarity Wins

As leaders, we often assume our message is clear. We see the vision vividly, like a movie playing in our heads.

An Impact So Great Our Community Would Weep If We Closed Our Doors

Part of our 412 Vision at Beratung Advisors is to have “An Impact so Great Our Community Would Weep if We Closed Our Doors.”

Generational Planning for Yinz

After eight years, we are changing our tagline from “Guidance with a Plan” to “Generational Planning for Yinz.”

4 Keys to Hearing God’s Voice

I first learned these 4 keys to hearing God’s voice on an L3 Mastermind Retreat from my friend Andrew Reichert, and it changed my life.