Over the last 3 weeks we have seen people show a lot of concern over the continuing Coronavirus pandemic. This concern has bled over to the financial markets. Over the recent weeks, all of the US major market indexes, the Dow Jones Industrial Average, the S&P 500, and the NASDAQ, entered into bear market territory. To put this into perspective, a bear market is when the markets drop by 20% or more from their high marks. This is the time when the worry will begin to set in, and you might begin to question your decisions as you see your invested assets decrease in value.

It is likely that the largest investment account you have is your employer retirement plan, your 401(k). This is what you use to fund the long-term goal of eventually retiring. You add to it with each paycheck and make sure to use care in choosing the right allocation so your account value will grow over time.

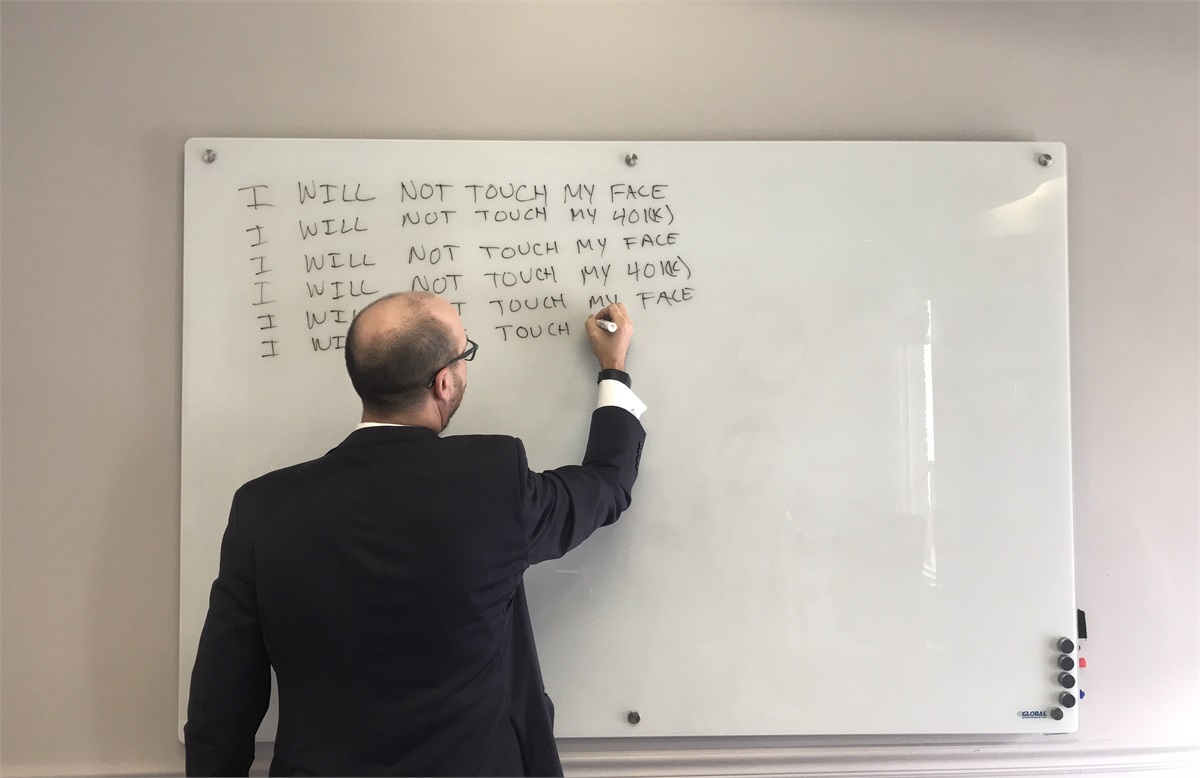

Right now, every time you look at your 401(k) the value is most likely continuing to decline. The thought of stopping the contributions or moving all the assets to cash to avoid further losses has probably entered your mind. People are emotional in nature. When things are negative, we want to move away from them, avoid them, or just ignore them all together. This is what happens with our investments and our goals in these tough times. Letting your emotions take over and ignoring your long-term savings by stopping your contributions in a time like this can hurt, not help, you.

There is little that can be done to curb the downturn. Even the best diversification strategy will probably see its share of losses in times like these. But there are things you can do to help your 401(k) during this bear market.

One of the most beneficial features of the 401(k) is that it allows workers to systematically add funds to the account with each paycheck. You probably already know of one benefit to your contributions, the deferral from your taxable income for that year. However, there is another benefit most people do not think about when it comes to their 401(k) contributions. This systematic addition of funds to the account helps you to grow your contributions by continuously buying additional shares of your investments in the account regardless of the market cycle. This concept is known as Dollar Cost Averaging, and it is an investment strategy that your 401(k) provides without you really even knowing you are doing it.

When you add each contribution to your 401(k) in good, bad, or indifferent market cycles you are buying more of the investments in the account. If the market is up significantly your contribution will be less shares as they are all selling at a higher amount. During a down market, or bear market like we are currently experiencing, the same dollar amount you contribute is buying you more shares of your investment. Basically, the market is “on sale” by 20% or more right now. So, all the contributions you make right now can be buying you more shares at a lower price and making the total cost per share of your investment lower in the long run.

Over these last few weeks, as I am having conversations with all of my clients to discuss their financial plans, I am making sure to remind all of them that now is not the time to lose sight of their long-term goals. Keep your planning in mind and keep your emotions from making the wrong choice. Now IS NOT the time to stop contributions. Now IS the time to stay disciplined and keep your contributions going into your 401(k) as dictated by your long-term plans. If you have the ability, now could also a great time to possibly increase your contributions.

When I say increase, this does not mean that you should be unreasonable and increase by a percentage that is not feasible. Adding another 1% to 2% at this time may be worth looking into. The best way to know if you should be increasing and by how much is determined by looking deeper into your financial plan and having a detailed discussion with your financial planner.

Remember the saying from Warren Buffet “be fearful when others are greedy and be greedy only when others are fearful.” You might be hearing colleagues saying they are pulling money out of their investments to cash or stopping their contributions. They are being fearful and emotional. Stay rational and mindful that markets go through cycles and this too shall pass. I believe you are only helping yourself in the long-term.

If you have done the proper financial planning and have a long-term strategy, use this time to help yourself long-term and think of this decline as a buying opportunity.

If you do not have a financial plan and want to speak with one of our professionals at Beratung Advisors about how we can educate and empower to make informed financial decisions, please contact us at 412-357-2002.

If you found this information useful please leave your comment on our Facebook post or on our advisors LinkedIn posts and share this post with your friends and family.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. The information presented does not constitute a solicitation for the purchase or sale of any security and is not a recommendation of any kind. Please consult your financial advisor before making financial decisions. Indexes discussed are unmanaged and you cannot directly invest into an index. Past performance is not a guarantee of future results. Dollar cost averaging does not ensure a profit nor guarantee against loss. Investors should consider their financial ability to continue their purchases through periods of low price levels. Diversification is an investment strategy that can help manage risk within your portfolio but it does not guarantee profits or protect against loss in declining markets. Investing involves risk, including the potential loss of principal. (03/20)

Make Your Vision Great Again: Why Clarity Wins

As leaders, we often assume our message is clear. We see the vision vividly, like a movie playing in our heads.

An Impact So Great Our Community Would Weep If We Closed Our Doors

Part of our 412 Vision at Beratung Advisors is to have “An Impact so Great Our Community Would Weep if We Closed Our Doors.”

Generational Planning for Yinz

After eight years, we are changing our tagline from “Guidance with a Plan” to “Generational Planning for Yinz.”

4 Keys to Hearing God’s Voice

I first learned these 4 keys to hearing God’s voice on an L3 Mastermind Retreat from my friend Andrew Reichert, and it changed my life.

Give ‘Em The Pickle

We believe that a big part of culture is shared language. We have a shared language we call the Beratung Vernacular that helps us all row in the same direction.

13 Lessons I Learned From My Dad

My father was called home to be with God 13 years ago on Thanksgiving Day, November 24th, 2011. Today would have been his 76th birthday. There is not a day that goes by that I do not think of my dad. In his memory, I wanted to share the 13 most important lessons he taught me, one for each year he has not been with me.