Let’s be honest: market downturns can feel scary. Red arrows, sensational headlines, and portfolio losses can trigger fear and uncertainty. But here’s the truth—market downturns aren’t just something to survive… they’re something you can leverage.

At Beratung Advisors, we help clients not just weather the storm but take advantage of it. A down market, while uncomfortable, is a moment packed with potential—if you know what to do.

Here are five moves to make when the market is down that can put you in a stronger financial position:

1. Tax Loss Harvesting (and Strategic Gain Harvesting Too)

Tax loss harvesting isn’t just for losses—it’s a way to turn market pain into potential tax gain.

When the market drops, some of your investments may show losses. By selling those positions and replacing them with similar (but not identical) investments, you can lock in the loss for tax purposes while keeping your portfolio strategy intact. These losses can offset gains or even ordinary income, giving you a tax break.

Even better? You can sometimes sell appreciated positions too—but because prices are lower than they were months ago, the gain is smaller and the tax impact is reduced. This lets you reposition your portfolio more effectively without the typical tax consequences.

2. Make Your Accounts More Aggressive

It may sound counterintuitive, but when markets are down, it can actually be less risky to shift to a more aggressive allocation.

Why? Because the market already took a hit—you’re buying at a discount. If your plan or risk tolerance calls for a more growth-oriented strategy, a downturn can be the right time to make that move. Going from bonds or cash to equities during a recovery gives you more upside with potentially lower downside risk than making the same move during a peak.

This isn’t about timing the market—it’s about aligning your investments with your goals and taking advantage of temporary mispricing.

3. Invest Cash & Increase Systematic Savings

“Buy low” is easy advice to give, but hard to follow when fear is in the air. Still, downturns are often the best time to invest.

Have cash sitting on the sidelines? Consider putting it to work in alignment with your financial plan.

Already investing monthly? Great. Now might be the time to increase your systematic savings. Those consistent monthly contributions are now buying more shares for the same dollars—which can dramatically improve long-term returns.

We call this buying while it’s on sale. And it’s one of the most powerful tools available to long-term investors.

4. Roth Conversions

Roth conversions turn traditional IRA money into Roth IRA money—tax-free growth and withdrawals for the rest of your life.

The best time to do this? When the market is down. You pay taxes on the value at the time of conversion, so doing it during a dip lets you pay less in taxes now and let the recovery happen inside a tax-free account.

This strategy is especially powerful for those in low-income years, nearing retirement, or with legacy planning goals. But it must be done carefully, with attention to tax brackets and timing.

5. Hire a Professional

There’s a lot you can do during a market downturn. But let’s be honest—doing it on your own is really hard when emotions are high and fear creeps in.

That’s where we come in.

It’s one thing to know the strategies. It’s another to actually execute them with confidence when the market feels chaotic. We help you stick to your plan, remove emotion from decision-making, and act with wisdom and clarity.

In fact, we’ve seen that many clients who originally hired us just for financial planning end up turning to us during volatile times to help manage their investments. Not because they couldn’t do it on their own—but because they realized the value of having a partner to walk with them through the storm.

You don’t have to go it alone.

Let’s execute the plan together.

Ready to take action?

Give us a call at 412-373-2002 or email us at contact@beratungadvisors.com

Final Thoughts

Downturns are uncomfortable—but they’re also inevitable. The good news? They can be a gift in disguise if you take the right steps.

Whether it’s harvesting tax losses, increasing equity exposure, investing cash, or rebalancing your plan, the key is to stay proactive—not paralyzed.

If you’re wondering how to implement any of these strategies, we’re here to help.

After all, we’re not just here to talk about planning—we’re here to help you take action when it matters most.

Ready to take action?

Give us a call at 412-373-2002 or email us at contact@beratungadvisors.com

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Always Be Branding – How to Pick a Name and Logo

When you’re starting a business, one of the biggest decisions you’ll make is choosing a name and a logo.

More Than a Logo: The Meaning Behind Beratung Advisors’ Brand

Our logo isn’t just about branding–it’s a constant reminder of who we are, what we do, and why we do it.

5 Smart Moves to Make When the Market Is Down

Here’s the truth—market downturns aren’t just something to survive… they’re something you can leverage.

Empowering Informed Financial Decisions: The Beratung Mission

At Beratung Advisors, we all have one job: to execute on our mission.

Why Property & Casualty Insurance Is a Critical Part of Your Financial Plan

An important part of financial planning—one that often gets overlooked—is your property and casualty insurance.

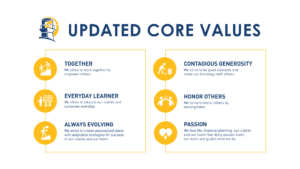

Refining Our Core Values: Making Them Clearer, Stronger, and More Actionable

At Beratung Advisors, our core values are the foundation of everything we do.