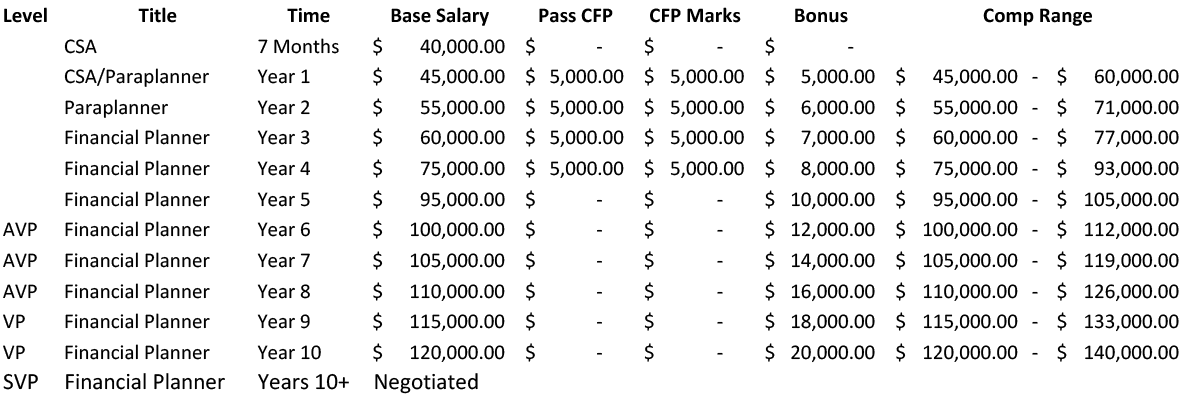

We are looking to add financial planners to our team that are brand new to the profession or less than 3 years’ experience. We place a high emphasis on being a CFP® professional and will compensate our planners for passing the exam and also for having earned their marks.

You Might Be A Great Fit

You are hungry for more professional and personal growth opportunities that are not being offered with your current company.

You are currently in a firm that values investment management over financial planning and looking for a culture that is planning focused and does investment management if needed.

You just graduated college and you want to get started in this profession without having to build your own book.

You are looking to charge for financial planning to offer your services to people that do not meet barriers that AUM models create.

You do not enjoy sales and prospecting but prefer to just work with clients to deliver advice.

Your current firm tells you they value financial planning but charge and compensate on investment management.

You want to start in the profession with a salary.

You are looking for training and development and not just a salary.

You are stuck in a non-solicit in a culture that is not the right fit for you.

You are expected to serve so many households that you cannot provide planning for all your clients.

You feel like you are on an island by yourself without a team to support you, your clients.

Leadership And Career Development

At Beratung we invest in our team members to grow and develop. Our team member are given a growth plan when they start with targets for growth of 30 days, 90 days, 180 days, 1-year and 5-years. We invest in your growth and development in many ways including:

- Quarterly leadership books

- Paid mastermind groups

- Annual national professional conference

- Annual local professional conference

- Annual team conference

- Weekly team trainings

There any many paths to grow with Beratung and here above are some common paths. We will work with you to develop your personal plan to become the person you were called to be.

Our Compensation

We compensate our financial planning professionals through salary, bonus, and benefits based on living our core values and executing on our mission (not on production). Our salary model is created on the following beliefs:

- We want a compensation system that does not pay people exclusively based on what they produce because…

- …they would begin at $0/yr until we can build a client-base and many people don’t want that starting point…

- …it potentially incentivizes a commission-based approach instead of a recurring revenue model…

- …it potentially stifles teamwork and collaboration.

- We want a compensation system that supports the development of a “profession” in our industry.

- We want a compensation system that is salary-based and not a draw against commissions or future production.

- We want a compensation system that offers a way to forecast what someone will earn based on their own career goals and ongoing activities/living core values/behaviors/skills/development/contribution.

- We want a compensation model that encourages and rewards planners that earn the CERTIFIED FINANCIAL PLANNER™ certification.

- We want a compensation system that allows a stay-at-home parent to still be a planner.

- We want a compensation system that will allow our Financial Advisors to be proud of the way they are paid.

- We want a compensation system that can be benchmarked against other professional compensation systems in our industry (amongst firms that do comprehensive financial planning).

- We want a compensation system that includes fixed and variable pay.

- We want a compensation system that rewards the planners who live our core values, deliver excellence and advocate for the Beratung brand through financial planning.

- We want a compensation system that allows the firm to maintain profitability during good times and bad.

- We want a compensation system that restricts the top salary and bonus of the highest paid team member from being greater than 10 times the lowest paid team member’s salary and bonus.

Our Current Salary Model for Financial Planners

This salary model is for 2023 and is subject to change. It also assumes a financial planner has satisfactory quarterly reviews and continues to want to progress toward being a client-facing CFP® professional. As you advance in your career you may chose alternative career paths in our organization with different salary ranges. This is not a guarantee, but our projections based on current compensation.

Our Benefits

- 401(k) with 3% match after 180 days

- 2 weeks paid vacation

- 5 paid sick/personal days

- All Federal holidays that fall on a work week, paid time off

- 6 weeks paid and 6 weeks unpaid maternity/paternity leave

- $2,500 Adoption assistance

- Employer paid low deductible health insurance

- Annual Education Reimbursement up to $5,250 which can include CFP® exam coursework

- First attempt of CFP® exam paid for

- Match Charitable donations for qualified charities up to $1,000 a year

- $100 a month reimbursement for eligible health lifestyle choices (for example gym membership, health coach, fitness equipment purchase)

- L3 Leadership Mastermind Membership

- 4 growth and development books per year

We are reevaluating and looking to add more benefits to encourage and reward out team for living our core values. Our current goal is to roll out Long Term and Short Term Disability and Basic Life Insurance by the end of 2023 and a paid vacation by 2024.

These goals and the current benefits are subject to change.

Our Hiring Process

Our Culture is our most important asset as a company and we staunchly protect it by hiring people that are a fit for our culture and share our vision. To ensure we are a great fit for each other, we generally follow the hiring process below. At any point, if you or we realize we are not a good fit for each other, we let each other know.

- Take Assessments

- Introduction Meeting with CEO

- Introduction Meeting with Director of Operations

- Introduction Meeting with Director of Financial Planning

- The Beratung Culture Meeting with CEO

- Meeting with a current Beratung Financial Planner

- Attend a Beratung Tuesday Team Training

- Dinner with senior leadership. If you are in a committed relationship, your significant other is expected to attend as well.

- Offer