We find that umbrella insurance is one of the most overlooked, least known insurance policies from clients we work with. They know about basics of home, auto, life and disability policies but not umbrella insurance. Yet it can be a low cost and important part of a lot of our clients plans.

What is it?

Liability protection is part of your home and auto policies which is called casualty coverage, or liability coverage. There are generally caps on how much liability protection you can have, which may be below the recommended amounts for certain clients. Umbrella insurance is an excess liability policy that increases your protection on policies like your home and auto getting you to the recommended protection you need.

Why do you need it?

Liability coverage is part of your home and auto policies and is usually about $250,000 to help pay for repairs, replacement, or medical costs in the cases where you are at fault for an accident. Now, this $250,000 maximum coverage might seem like a lot when you think about basic accidents. Things like:

- You rear end another driver with your car.

- You would be at fault and your insurance would cover the damages to the other car.

- These might be as simple as a new rear bumper and some paint

- Someone falls at your house and breaks their arm.

- They might need to go to the emergency room and get the arm put in a cast.

- Your coverage would pay for these medical expenses.

What if, in the examples above, the injuries were much more serious and the person went to the hospital, required surgery and will miss work for a number of months? In this case it may seem that $250,000 might not be enough to cover their repairs, medical costs and lost wages.

This is why the discussion of umbrella policies is included in our financial planning process. An umbrella policy gives you additional liability in excess of your liability maximum in your home or auto insurance policy. These policies typically come in $1 million increments and provide more liability coverage for relatively low costs to add to your other policies.

In the examples, the person was seriously injured, the medical bills, damages and lost wages might result in you being liable for $750,000 in damages. Let’s say you have an umbrella policy for $1,000,000 in addition to the $250,000 in your auto policy. The first $250,000 would be paid from your auto insurance or homeowner’s policy, and the other $500,000 would be covered by the umbrella policy.

This may seem like an extreme example, but it’s possible. And without the umbrella coverage you would be paying that $500,000. This might mean selling your home, wiping out bank accounts, cashing in investment accounts or even having judgement on your future income. So, the extra cost to per year to get a $1,000,000 umbrella policy may be protection worth paying for.

How much do you need?

Start with how much you have, or if you even have it. You can find this by reviewing your declaration pages in your policies. These pages give an overview of your coverages and what you are paying for premiums and deductibles.

Once you know how much you have, you will want to see what the impact of possible accidents has on your financial plan and how much risk you are comfortable taking. A financial planner can help you model and look at these scenarios to determine your needs. Then you speak with your insurance agent to see how to change your coverage to meet your needs.

What do I do with this information?

Talk to a financial planner. An umbrella policy along with your other lines of property and casualty insurance are just one of the important parts of your comprehensive financial plan. It can seem complicated and cumbersome but that is where we can help you. If you want to understand what you have and how it fits into your financial plan, give us a call at 412-357-2002.

LPL Financial does not offer umbrella or other types of liability insurance. This is meant for general educational purposes only. It should not be considered specific advice, nor does it constitute a recommendation to take a particular course of action. Please consult with the appropriate professionals regarding your personal situation prior to making any financial related decisions.

More Than a Logo: The Meaning Behind Beratung Advisors’ Brand

Our logo isn’t just about branding–it’s a constant reminder of who we are, what we do, and why we do it.

5 Smart Moves to Make When the Market Is Down

Here’s the truth—market downturns aren’t just something to survive… they’re something you can leverage.

Empowering Informed Financial Decisions: The Beratung Mission

At Beratung Advisors, we all have one job: to execute on our mission.

Why Property & Casualty Insurance Is a Critical Part of Your Financial Plan

An important part of financial planning—one that often gets overlooked—is your property and casualty insurance.

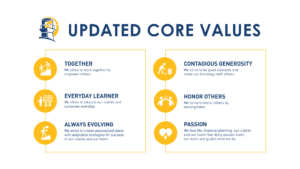

Refining Our Core Values: Making Them Clearer, Stronger, and More Actionable

At Beratung Advisors, our core values are the foundation of everything we do.

Make Your Vision Great Again: Why Clarity Wins

As leaders, we often assume our message is clear. We see the vision vividly, like a movie playing in our heads.