Why is my home and auto insurance important?

We often find that most clients neglect the role their home and auto insurance play in their financial plan. In this post I will discuss some of the basics and their importance to your financial plan.

When I work with clients to create a financial plan they often come to the first meeting well aware that we will be discussing their goals and their assets during the planning process. During our first meeting we discuss their financial picture and many clients even bring statements and other documents to help me see what they have. They are usually very surprised, and sometimes confused, when I ask about their home and auto insurance.

They are surprised because they do not think about these when they think about planning for goals such as retirement. Almost all of us have them, we pay for them year in and year out, and often just view them as a line item on our expense sheet without much thought. We find most people only think to look at them after being prompted by a commercial that says they can save money.

However, your home and auto, which are lines of property and casualty insurance are an important part of the financial plan. In the planning process we will review these and and can provide you with guidance on how to help make sure you have proper and adequate coverage. Without proper coverage, an auto accident or a guest getting injured at your house could cause you major financial distress and potentially push back your plans for retirement.

When I am done with planning process I will usually get a response from clients that they had no idea just how important these policies were to their overall financial plan, but they are glad they have reviewed them with us.

Let’s break it down

What is property and casualty insurance? This is the insurance you carry to protect you, your family, and the things you own in cases of accidents and injuries. The explanations are right in the names.

Property Insurance: Covers the property you own. Items such as:

- Your Dwelling

- House

- Condo

- Rental Property

- Your Vehicle

- Car

- Motorcycle

- RV

- Your Possessions

- The items you keep inside your dwelling and/or your vehicle

The property part of the insurance protects these in cases of theft, vandalism, fire, or other damage that you are not at fault for. You insure for the value of the property and what the cost is to replace it.

In cases such as these you are protected for the value of the property and what the costs will be to repair or replace it. Some examples might be:

- You are in an accident and your car is totaled.

- In this case your insurance must provide you funds to replace your car based upon its current value.

- Your home is broken into and items are stolen.

- This would be a case where you don’t need to replace the entire house, but you need to replace the value of the items that were taken.

- Your house is struck by lightning and burns down completely.

- Here is an instance where your insurance would be needed to replace the entire value of your home and the possessions inside.

Casualty Insurance: Covers you in the cases where you are the one at fault.

You will often see this referred to as liability protection, because it protects you in cases where you were the person who either caused the damage/injury or it happened on your property. You have this insurance to help make sure your personal assets are not at risk if someone is hurt or their property is damaged.

Some very common examples of the need for casualty insurance are:

- When you rear end another driver in your car.

- You are at fault and must use your casualty insurance to pay for the repairs to their car.

- These repairs would be minor, maybe a new bumper and some paint, so your casualty insurance covers this.

- Someone falls and is injured because of a faulty step at your home that should have been repaired.

- Your policy would be used to pay for their medical care, and not have to pay out of pocket for costly medical care.

Most casualty policies carry a minimum amount of liability coverage, often $250,000, but sometimes it is important to further protect yourself with additional liability coverage. This is usually referred to as an umbrella policy, and this can add $1 million or more in additional liability coverage to your policy.

What do I do with this information?

Talk to a financial planner. Your property and casualty insurance is just one of the important parts of your comprehensive financial plan. It can seem complicated and cumbersome but that is where we can help you. If you want to understand what you have and how it fits into your financial plan, give us a call at 412-357-2002.

LPL Financial does not offer property or casualty insurance. This is meant for general educational purposes only. It should not be considered specific advice, nor does it constitute a recommendation to take a particular course of action. Please consult with the appropriate professionals regarding your personal situation prior to making any financial related decisions.

Always Be Branding – How to Pick a Name and Logo

When you’re starting a business, one of the biggest decisions you’ll make is choosing a name and a logo.

More Than a Logo: The Meaning Behind Beratung Advisors’ Brand

Our logo isn’t just about branding–it’s a constant reminder of who we are, what we do, and why we do it.

5 Smart Moves to Make When the Market Is Down

Here’s the truth—market downturns aren’t just something to survive… they’re something you can leverage.

Empowering Informed Financial Decisions: The Beratung Mission

At Beratung Advisors, we all have one job: to execute on our mission.

Why Property & Casualty Insurance Is a Critical Part of Your Financial Plan

An important part of financial planning—one that often gets overlooked—is your property and casualty insurance.

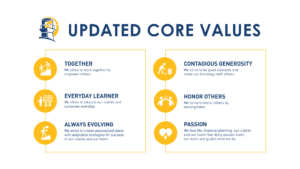

Refining Our Core Values: Making Them Clearer, Stronger, and More Actionable

At Beratung Advisors, our core values are the foundation of everything we do.